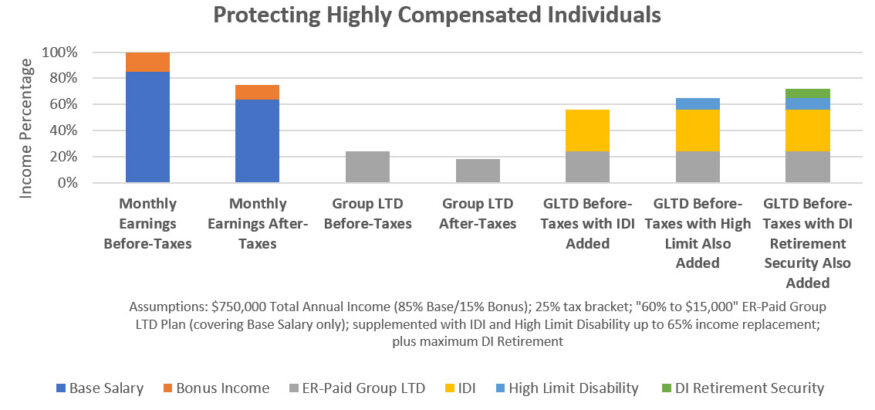

Protecting Highly Compensated Individuals

It can be challenging to face the fact that a disability can happen to anyone. In truth, most wage earners believe they have little chance of becoming disabled for three months or more during their working career. However, statistical data paints a much different picture – over 1 in 4 of today’s 20-year-olds will become disabled before they retire1. Highly compensated individuals are not immune to this fact.

Regardless of the level of income, most people have financial obligations that consume 60%-70% or more of their income2. Like most Americans, highly

Recent Comments