Protecting Highly Compensated Individuals

It can be challenging to face the fact that a disability can happen to anyone. In truth, most wage earners believe they have little chance of becoming disabled for three months or more during their working career. However, statistical data paints a much different picture – over 1 in 4 of today’s 20-year-olds will become disabled before they retire1. Highly compensated individuals are not immune to this fact.

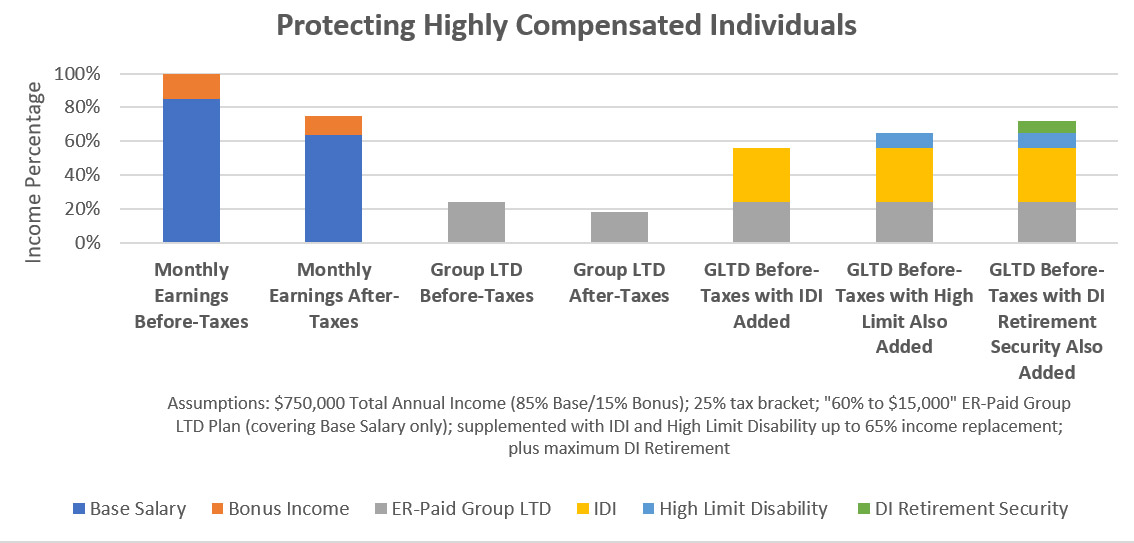

Regardless of the level of income, most people have financial obligations that consume 60%-70% or more of their income2. Like most Americans, highly compensated individuals often maintain modest savings accounts relative to their monthly expenditures. This means that even those earning high income will experience financial distress when income cannot be replaced during a period of disability – with the generally agreed-upon standard being 65% of income. Experience has shown that highly compensated individuals are often left grossly underinsured when measured against this standard, putting their greatest asset – future income – at great risk to an illness or injury.

Here is a strategic, tiered approach for safeguarding the financial well-being of highly compensated individuals:

Group Long-Term Disability (LTD)

Highly compensated employees working for an employer providing disability insurance as part of their benefits package are likely enrolled in a Group LTD plan.

These plans are typically designed to cover 50-60% of an individual’s W-2 income or base salary up to a designated monthly cap. For highly compensated individuals this means benefits, bonuses, commissions, retirement plan contributions, and commonly paid incentives are not generally included in the formula to determine benefits.

The most notable advantage of a Group LTD plan is the price. Since group disability plans spread risk over a large volume of people, the cost for coverage is lower. Additionally, most Group LTD plans do not require physical examinations, so everyone who opts in receives coverage.

However, Group LTD plans are not without limitations. For one, they are typically not portable – meaning if an individual leaves their current employer, the Group LTD coverage does not go with them. Additionally, benefits from a Group LTD plan are taxable in most cases, so even if 60% of salary is provided, the take-home is much less due to taxes on those benefits. Consider the difficulties highly compensated individuals will face to maintain their current lifestyle from Group LTD alone, with benefits only reaching 15-40% of income after taxes.

Even so, the structural foundation provided by this tier of coverage is a terrific starting point.

Individual Disability Insurance (IDI)

This policy more inclusively defines total income and becomes a very effective way to supplement Group LTD. Individual disability insurance is a private policy owned by the insured – meaning it’s portable when changing jobs and the benefits are typically tax-free. Individuals can obtain this protection independently (with full medical underwriting), through a discounted multi-life plan, or as part of a Guaranteed Standard Issue (GSI) solution (requiring no medical underwriting and even greater discounts).

This tier of coverage adds tremendous value by helping the insured pay bills, take care of family, and maintain a current lifestyle should they become ill or injured and unable to maintain their income.

For the self-employed or those that do not have Group LTD coverage through their employer, an individual policy is the best source of income protection. Sound financial advice demonstrates how disability insurance fits into everyone’s larger financial plan. Discussing the best option based on an individual’s situation with a financial advisor becomes critical to seeing that plan through.

Personal High Limit DI

Highly compensated individuals face unique challenges when it comes to being adequately protected against disability. As income increases, the “Issue & Participation Limits” of traditional DI carriers begin to decrease as a percentage of income, becoming insufficient for properly insuring highly compensated individuals. As a result, another tier of coverage is often required to attain the 65% income replacement standard.

A Personal High Limit DI plan specifically meets the needs of high-income earners. Benefit payments from this tier of coverage come in the form of monthly benefits, a lump-sum payment, or a combination of the two. They are paid in addition to Group LTD and Individual Disability Insurance. Therefore, this level of benefits becomes essential to sound financial planning for highly compensated individuals.

DI Retirement Security

Frequently considered the “forgotten tier” of coverage, DI Retirement Security aids in the continuation of saving for retirement regardless of unexpected events. DI Retirement Security is an individual insurance policy that directs monthly benefit payments to an irrevocable trust when a disability occurs. Those benefits are invested based on risk tolerance and become accessible as retirement income later.

Typically, no evidence of “retirement savings” or history of savings is required to obtain this tier of coverage. The monthly benefits available are in addition to Individual DI limits.

Every income earner needs disability income insurance to either pay bills, replace a portion of lost income, maintain a lifestyle, protect the family from needing to liquidate hard-earned assets, or keep from falling into serious debt. With highly compensated individuals, these realities can be even more pronounced should an illness or injury occur—the stakes are much higher. Sound financial planning begins and ends with income planning, which isn’t possible without adequate disability insurance. This strategic, tiered approach provides a blueprint to protecting highly compensated individuals against the risk of disability.

1 U.S. Social Security Administration Fact Sheet; 2 CONSUMER EXPENDITURES, U.S. Bureau of Labor Statistics

Recent Comments